Blog

9 Key relationships every asset finance broker should be exploiting

Building your asset finance business is challenging. It requires commitment, determination, and sound strategy to excel and rise to the top of the industry.

Maximising your brokerage income from every client

Maximising your broker brokerage income from every client. Learn the secrets many top brokers don’t want you to know on boosting brokerage income.

Asset Finance uptake continues to surge – what are the opportunities for brokers?

As businesses continue to fight-off the effects of the pandemic, thornmoney is backing brokers wanting to secure their share of a growing $40 Billion asset finance sector.

Broker marketing consultant gives top tips on how to maximise 2022

Brokers are being advised on to best increase their business in 2022, with a leading marketing consultant releasing a series of tips that brokers can utilise to prime themselves for a great new year.

Plan like a boss. Seven tips to end this year as a Top Broker.

Yes, I know we’ve only just stepped into the new year. But, if you’ve been around in business or sales for some time, you know that now is the time to set the year up and plan the outcome you want. My strategy is to always start with ‘the end in mind’. If you’re someone who is committed to achieving extraordinary goals – this article is especially for you!

The post lockdown revival will test your business cashflow.

Businesses will need to be well prepared and ready for the influx of new business during an unprecedented post lockdown revival. Cashflow is most definitely king, and businesses will need to hold tabs on their business finance warns thornmoney

Don’t risk your home to get a business loan

Whilst using your home as security can be the cheapest way to secure business finance, many savvy businesses are discovering they don’t need to use their home as security to fund their business growth. Business funding solutions have evolved to make business growth easier for SMEs and company owners.

‘Is your business reopen ready?’

For many, it has been a long time since there was something to celebrate. The approaching easing of restrictions and end of lockdown as we’ve known it is a good cause for celebration. But is your business ready to restart? Now is the time to start preparing, here are some juicy tips to help you get your business ready to press the START button.

Having an ATO debt doesn’t instantly prevent business owners from accessing business finance

Our guest editor, John Maxwell, Director & Senior Consultant of Cocalex Consulting, provides this topical article on accessing business finance as the ATO deadline approaches. Paying taxes is a normal part of running business. Incurring an ATO tax debt can put pressure on business cashflow, which is a reality for many business owners across Australia. However, this doesn’t automatically rule you out from achieving finance approval.

Brokers are leaving money on the table in 2021

Many brokers are missing out on easy revenue by not fully investigating and assessing the full financial needs of their clients.

7 signs your business may need to seek out funding solutions

Operating a business has become increasingly stressful in the current economic environment. In recent years, we’ve seen businesses tested by a variety of natural disasters including flooding, drought, bushfires, and the current prevailing COVID-19 global pandemic.

More and more disgruntled brokers are leaving the industry, according to expert

Stress, regulations and Covid are causing more and more brokers to call it a day, according to one industry expert.

John Maxwell, founder of Cocalex Consulting, told Australian Broker that he was seeing increasing numbers of brokers questioning the worth of their efforts in the pandemic-afflicted, post-royal commission industry.

Top 10 mortgage hacks

With a financial services career spanning more than 21 years, I’ve discovered it’s NOT knowledge that most of us struggle with, it’s retaining the vast amount of knowledge. On that note, I’ve compiled my ‘Top 10 mortgage hacks’.

Are you communicating effectively with your customers right now?

The COVID-19 pandemic has changed life as we know it, especially when it comes to communication channels. It is likely to still be some time before we resume, as a community, a level even close to anything considered normality when it comes to business and customer meetings. Emotions are running rampant as we one by one experience ‘cabin fever’ and a state we all know as ‘stir-crazy’.

Client fallen into radio silence?

Especially in times of a crisis, it's very likely you will experience more clients who go 'underground' and suddenly stop communicating mid-application. As a highly experienced [previous] mortgage broker, I'd like to offer my perspective on this matter, which hopefully will be of use to you and your team, given the current circumstances we are all experiencing.

Debt recycling is the secret success strategy you’ve never heard of…until now!

Ever wondered how some people tend to build wealth and property whilst you continue to battle the bills and life's challenges, never really reaching the position where you can buy an investment property? It could be due to several factors.

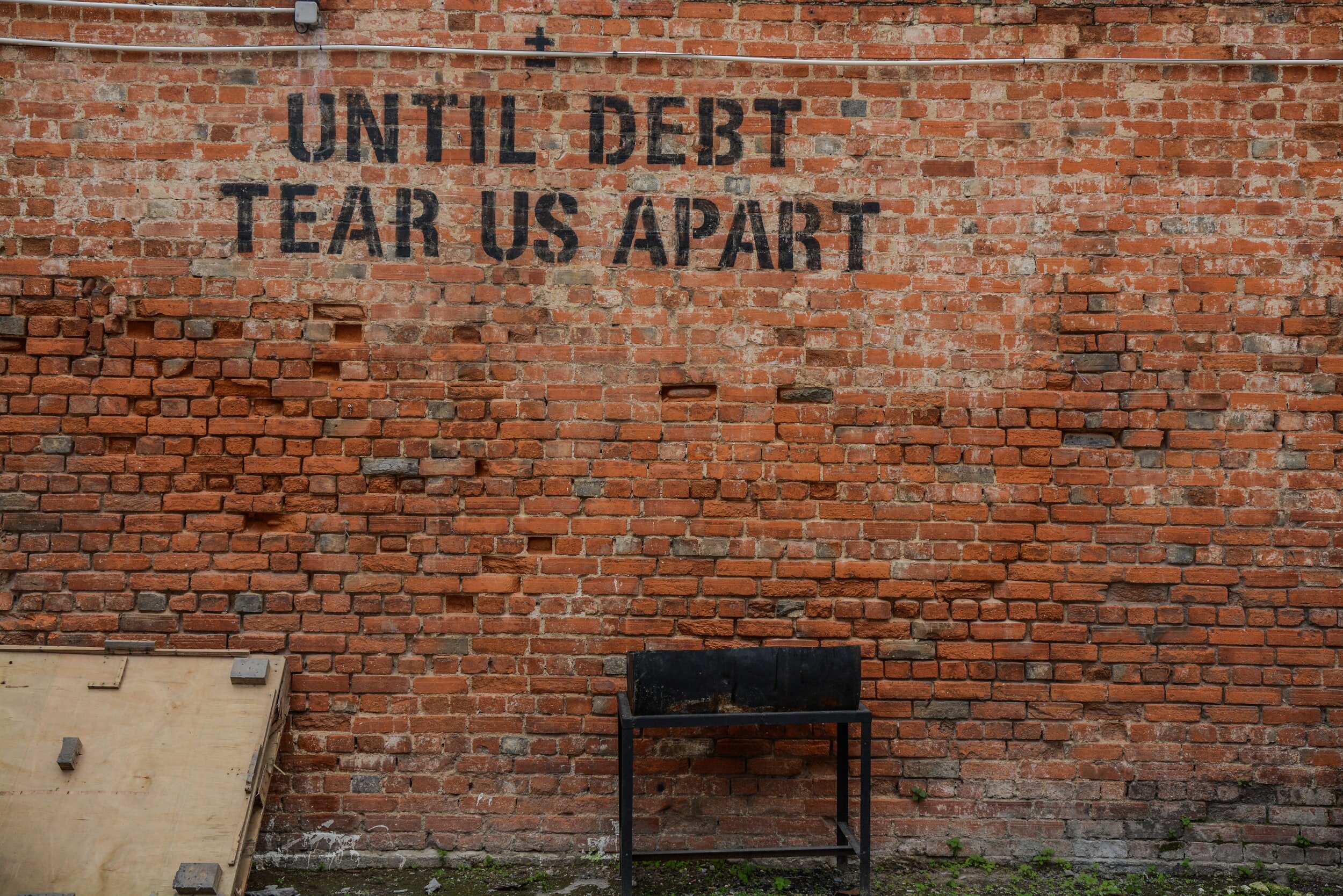

What’s the difference between good debt vs bad debt?

If you’re a homeowner, a first-time property investor or about buy your first home or investment property, developing a sound understanding about the difference between good debt vs bad debt is a critical foundation in your property education journey.

Access to finance a problem for small business - an industry opportunity?

The Australian Small Business and Family Enterprise Ombudsman has welcomed government moves to reduce regulatory barriers to entry for new entrants to the banking system. Treasury is consulting on proposed changes to the Banking Act, which would allow use of the word “bank” by authorised deposit-taking institutions.